How does it work?

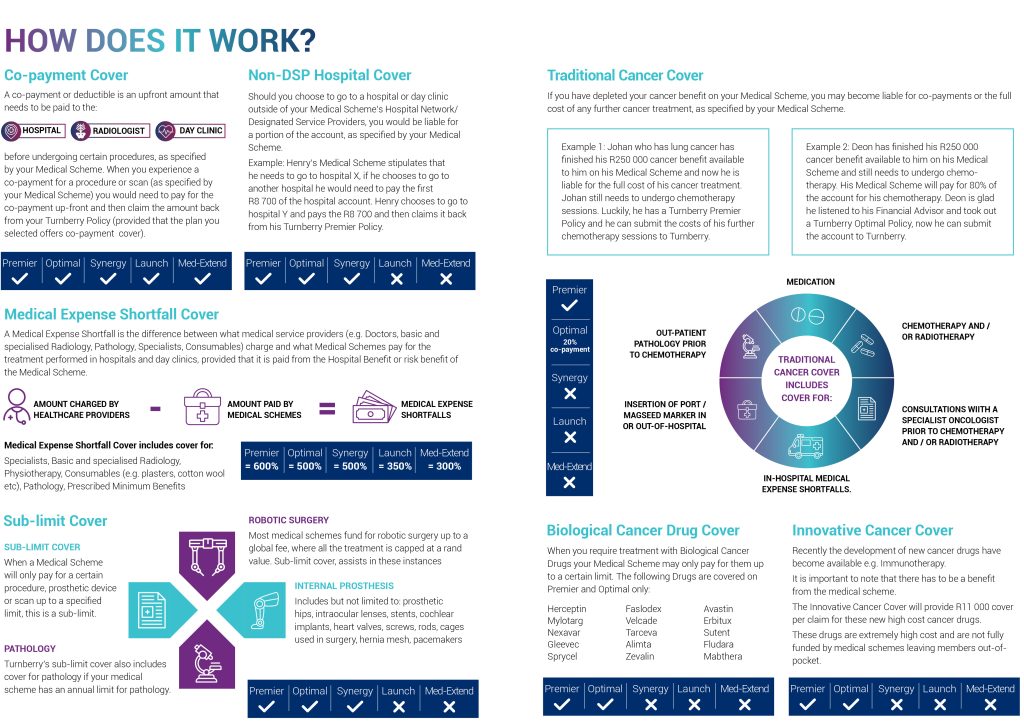

Gap cover is a short-term insurance product that helps protect you from medical expense shortfalls, which happen when your doctor charges more than the medical aid rate for in-hospital treatment, or the hospital charges copayments for operations. These unanticipated expenses can leave you with an unexpected financial burden that you will have to pay for out of pocket. With rampant medical inflation and the cost of medical procedures constantly increasing, this could easily run into hundreds of thousands of Rands.

As medical aids are under constant pressure to balance benefits with affordable contributions, they have had to resort to creative strategies to attempt to maximise coverage. This means that co-payments now exist where previously there were none, and members are now being restricted to using certain providers at certain networks, with penalties applied if patients go outside of these networks.

Gap cover should be part of your financial planning no matter your age or life stage. It is never too early to start thinking about your financial future, because the sooner you start the more time you have to plan, save and invest. Effective financial planning is essential whether you are in your 20s, your 80’s or any age in between, and this does not just mean having retirement annuities in place. With the rising cost of medical treatment and increasing shortfalls in medical aid cover, medical expenses can easily become a burden, and while you are typically young and healthy earlier in life, accidents happen and the older you get, the more likely you are to need costly medical treatment. Gap cover has become a vital part of a comprehensive financial planning toolset, no matter what your current age or life stage is.

or if you need a Turnberry representative to contact you to assist with the soution to suit your needs, please click here.

Claims paid by Turnberry over the past 12 months

Client Testimonials post claim submissions

I first learnt about Turnberry when my 1st born needed to get his own medical, and because medical schemes are so expensive, I had to take a plan which we could afford. I took out a Turnberry policy for him and when he was in a serious accident, we could not afford the cost of the helicopter which needed to fly him to Pretoria but Turnberry paid the expenses. That was when I decided to take out a Turnberry policy for myself as well. Because of your excellent services I have already promoted your product to all my friends and lot of them have also signed up with Turnberry. Thank you for your excellent service. I do not think that anyone with any medical scheme can be without your product.

By covering my medical aid shortfall and providing a sense of comfort knowing my family will be taken care of. The premium amount is worth the peace of mind. I score their assistance and support 10 out of 10.

Turnberry’s Gap Cover has been a tremendous financial relief based on present and past claim experiences. This is such an essential insurance necessity. I found the services and support I received from Turnberry to be efficient, friendly and professional. A Gap Cover policy is of vital importance for peace of mind and to meet medical aid shortfalls. The premiums in the most would be affordable anyway. I rate Turnberry’s services as ‘par excellence’.

Gap cover stepped in where my medical aid fell short for two different procedures.

That gap money was a life saver as I had to pay that out of my savings that I was building up to buy a home! I’ve been paying gap cover for 15 years and not needed it until 2022. But as the saying goes, it never rains it pours. And in 2022 I needed to claim for two completely different procedures within two months of each other. So, you can imagine what that did to my savings… When I did need it, I was so grateful that I had it.

Turnberry’s Gap Cover paid for all shortfalls and co payments. Saved me tons of money. Efficient and timeous payments. One less thing to worry about since my husband was diagnosed with terminal illness. Gap has also paid a benefit for his illness and the monies was much needed as my husband has been unable to work since Nov 2021. What would I say to people thinking about taking out Turnberry Gap Cover – ‘No need to think about it just join them’.